Wayne and Gladys Valley Center for Vision

A new home for innovation, discoveries, collaboration, and more to help all who suffer from visual disability and blindness.

No results can be found

We’re on a mission to ensure that everyone in the

world can see.

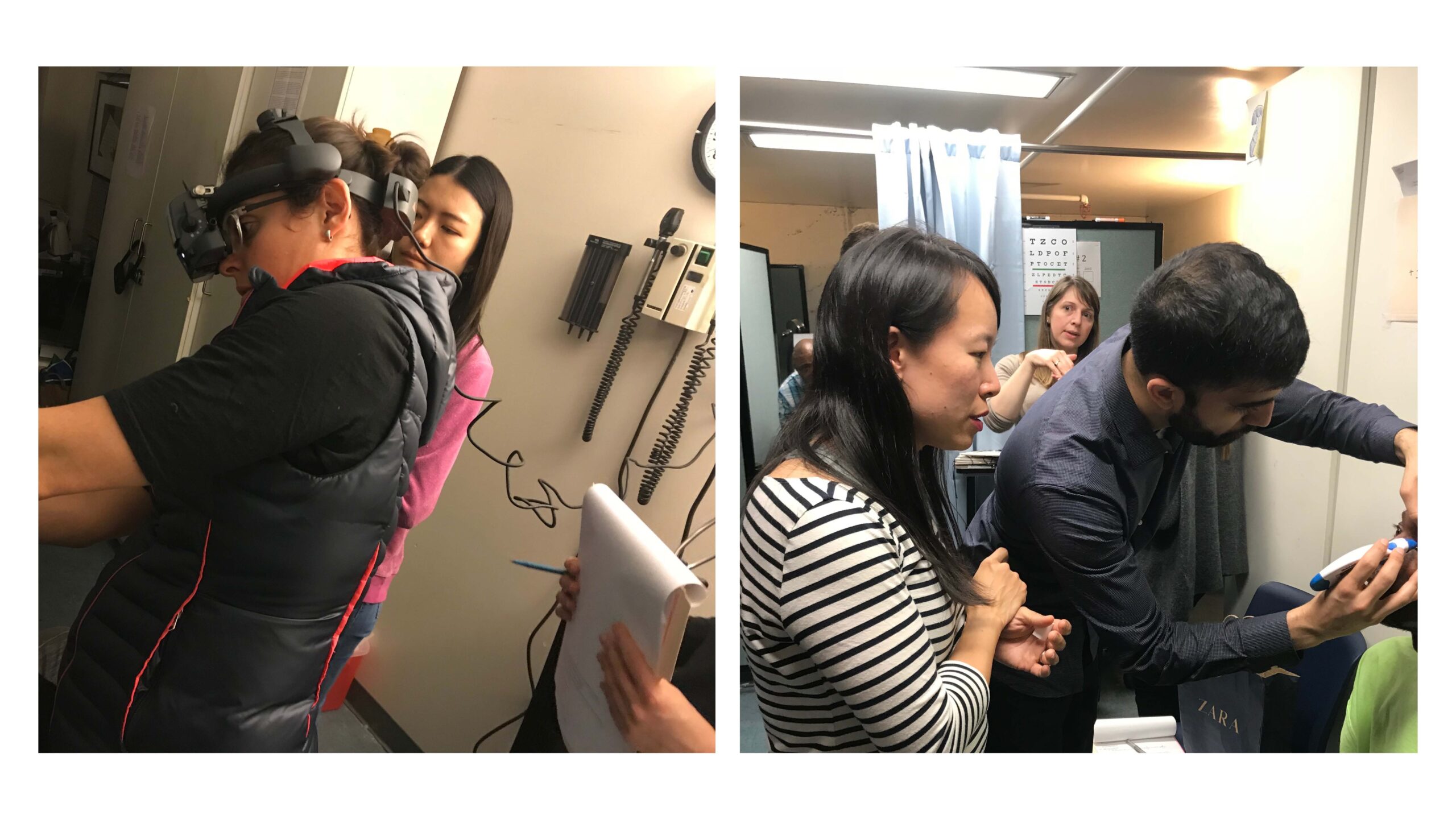

The UCSF Ophthalmology Shelter Clinic, operating within Division Circle Navigation Center (DCNC), is seeking funding support through All May See Foundation, to enhance our ongoing efforts in providing essential eye care services to the unhoused population at DCNC. Their mission is to eliminate barriers to eye care for the underserved and to prevent avoidable vision loss through early detection and treatment.

Read the Article

All May See Foundation was honored to join little Mackenzie Fredeen and her family at UCSF Benioff Children’s Hospital for her bell-ringing ceremony. We’ve followed Mackenzie on her cancer journey in our 2020 and 2021 Vision magazine stories.

Read the Article

of vision impairment

worldwide is curable

of adults 75+ in the US will develop Macular Degeneration

of all learning happens

through our eyes

All May See Foundation is a 501(c)(3) nonprofit that provides fundraising support for UCSF Ophthalmology and Francis I. Proctor Foundation for Research in Ophthalmology.

Your contributions directly fund each of these initiatives.

Research

Early-stage research and large-scale, multi-year projects led by specialized teams that result in life-changing innovation

Learn more

Education

Opportunities such as scholarships, research, and new technology for UCSF Ophthalmology medical students, residents, and fellows

Learn more

Patient Care

Resources to attract and retain the best physicians from around the country who provide unmatched, world-class care

Learn more

Global Outreach

Support for physicians to better understand and meet the needs of underserved communities locally and across the globe

Learn more

The investment of time and resources necessary to accelerate scientific breakthroughs and deliver the highest quality patient care requires substantial funding. We count on the support of generous donors to make this work possible. Together, we can ensure that, one day, all may see.

What we’ve accomplished thanks to your donations:

Current needs: